The market at work: Market theorists assure us that the market system operates to reward those who serve us well and put those who don't out of business. One can only wonder at the strange world we live in and the remarkably different market we have in aged care.

To an outsider it seems to reward those who David Malouf in his 1998 ABC Boyer lectures writing about Australia's entrepreneurial heritage describes as "seizing the main chance and capitalising on the weakness of others".

As I will show on later pages, it also seeks to silence those who complain, and crush those who think what is happening is not fair and speak out.

Tip: Click to expand (+) or collapse (-) content on this page

Introduction

AUSTRALIA'S aged care sector offers investors a defensive earnings stream, with government funding reforms further raising potential returns, Deutsche Bank says.

"The growth outlook is supported by rising wealth levels amongst the elderly which will provide opportunities as demand for higher end services expand," - -(analysts) - -.

"It also supports the funding outlook given individuals will inevitably be required to fund an increasing share of the cost," they said, noting the July 2014 funding reforms provided a material opportunity for providers.

(Company) - - has become a leading player in the ongoing consolidation of the fragmented residential aged care sector,

Source: Aged care the place to be, says Deutsche Bank - The Australian, 28 Jan 2015 (Paywall)

Government policy since 1997 has been to bring in local and global international companies to 'rationalise' and 'modernise' this 'immature' marketplace by 'consolidation'. As revealed in this quote, they structure funding to help corporate providers, shift the increased costs to the aged and their families, and increasingly allow providers to set their fees without restricting what they can demand. This is a market where there is a shortage and the providers can dictate.

A problem with economic rationalism is that true believers see it as the solution to problems in society. But it is people who solve problems. Markets in and of themselves don't solve human problems. Canadian John Ralston Saul, one of the strongest critics of our free market ideology sets out the esential problems in what our societies are doing and then goes on to repeat the warning that Adam Smith gave to society over 200 years ago.

Our essential difficulty is that we are seeking in a mechanism, which is necessary, qualities it simply does not possess. The market does not lead, balance or encourage democracy. However properly regulated it is the most effective way to conduct business. p 138

Trade, like any other economic mechanism, can be extremely helpful in the right circumstances. It cannot in and of itself solve societal problems. p 146

Source: John Raulston Saul 'The Unconscious Civilization' - The Massey Lectures, Penguin

(Commenting on the obvious benefits of trade)

The more commerce the better - - - - (but qualifying that) - - - No sensible, intelligent person would imagine that our desire to buy and sell as effectively as possible should eliminate other considerations.

And of course trade and economics do not stand alone. Without us they don’t exist. And being subsidiary activities, if allowed to lead the way, they will deform every aspect of our society. p53

Economics has to fit into its proper place. And in an advanced civilisation that is usually about halfway down a list - - - -. (problems occur when political leaders ) don’t have the commonsensical energy to maintain the public good above private interests. p54

A sensible society is therefore very careful when it comes to market fashions parading as intellectual truths. And it never lets such a perpetually virginal domain as economics get control of the public agenda. p 55

Source: John Ralston Saul On Equilibrium Section The economics of Common sense p53 Penguin Books 2001

Analysts periodically become wildly enthusiastic about the commercial opportunities offered by some sector in society and and beat it up. Aged care now gets its share of that.

The changes in funding made by the Abbott government were introduced to get 'consumers' to pay more and so encourage markeplace competitive consolidation and so set the process in motion.

... The number of facilities being sold is more than I have seen in 20 years in aged care," he (director of Ansell Strategic) told Australian Ageing Agenda. "We have sold just under 30 nursing homes in the last 12 months, and I would say I have probably sold six or seven in the 15 years before that ..."

Source: Investor appetite builds in aged care Australian Ageing Agenda, 3 Oct 2014

Eight months later this is what it looked like and its still accelerating. Aged care is changing and its changing dramatically. It is and will continue to be a major change in the way aged care is provided and it is being done without community discussion. They have little understanding and have not seen the evidence showing that this is not in their best interests. They have long since forgotten the debate and the warnings.

The wave of consolidation in the $13.2 billion aged care sector is expected to continue as the number of older people grows and government regulations increase compliance costs.

The sector, previously occupied by smaller and family owned aged care and retirement village operators, is increasingly dominated by large corporate players which are poised to grow even bigger.

Six major players – FPCompanyG, FPCompanyH, FPCompanyI, FPCompany NewnameC, INTFPCompanyB and FPCompanyJ – control 29 per cent of the stock but 52 per cent of the development pipeline.

"If you look at the majors, they only have between 5000 and 6000 beds each; there's a lot of consolidation still to come in the market," Mr Smith said.

More than $2.5 billion has been invested in public floats in the past 14 months as the operators in the aged care sector become major listed players.

Source: Age of change as big players expand in aged care sector Sydney Morning Herald, 24 June 2015

Aged-care provider FPCompoanyI is on track to hit its target of operating 10,000 beds by 2020 after partnering with Living Choice Australia to develop new facilities.

FPCompanyI chief Pxxx Gxxxx said the company had clearly explained its growth strategy, which includes acquisitions and organic development through brownfield and greenfield expansions.

He said the company would continue to add 500 to 1000 beds each year through deal activity. The company is also targeting one medium to large company acquisition.

Source: FPCompanyI, Living Choice sign deal to develop facilities The Australian, 26 Jun 2015 (Paywall)

The current buzz words are consolidation and growth. Consolidation occurs by mergers, takeovers and sometimes building new facilities. It is being driven by big market listed corporations in pursuit of profits for their shareholders. The smaller providers and the not-for-profit providers who are there primarily to serve their communities are being squeezed out.

The big companies need money for this - lots of it - and then they have to pay it back with interest.

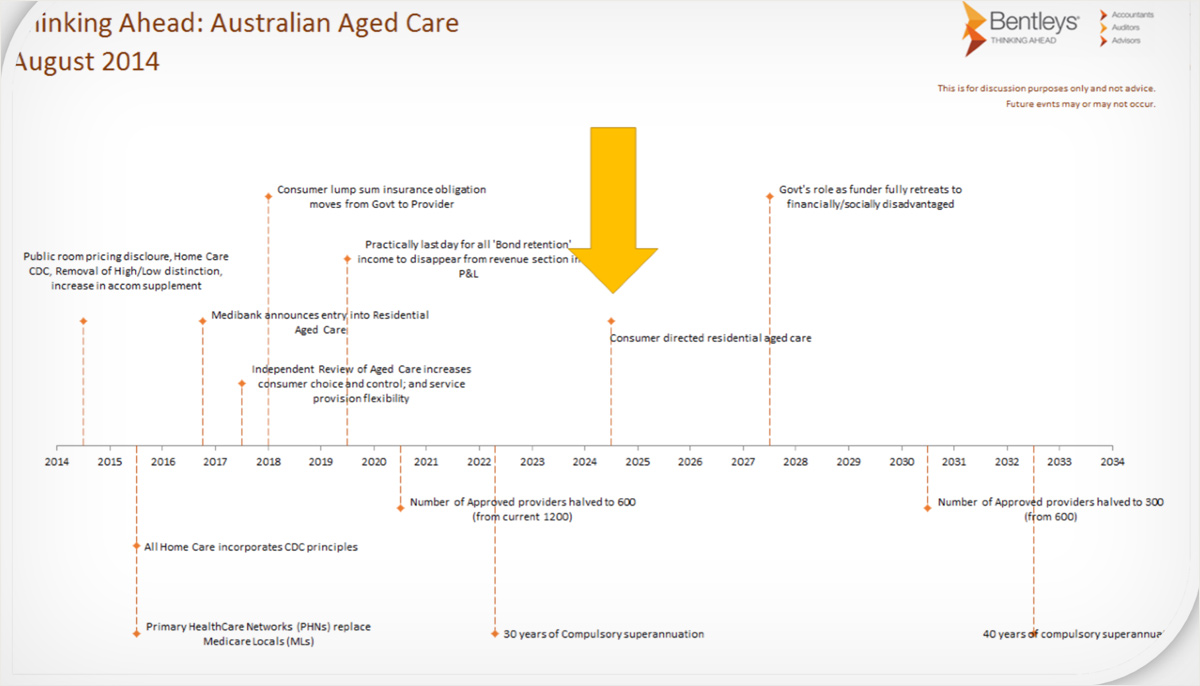

Competitive consolidation to reduce 1,200 providers to just 300 in 15 years time

During 2015 financial analysts Bentleys gave presentations to ACSA, the body representing not-for-profit aged care providers and LASA, the body claiming to represent all providers of aged care. Bentleys is commissioned by ACSA to report to it on the marketplace annually. That report is not publicly available

Included in both presentations was a slide which is a timeline for the governments aged care roadmap as Bentley’s understands it. Provider peak bodies and aged care consultancies have worked closely with government to develop the Aged Care Roadmap so this slide will accurately reflect what has been planned for Australian citizens behind their backs.

The slide suggests that the intention of the reforms is to halve the number of approved providers to 600 from the current 1200 by 2021 and halve it again to 300 by 2031. This is like turning the stove onto high and then getting cinders for dinner.

It is clear that only a minority of providers across the country will survive the scorching and it will be those who develop the sort of profits that allow them to acquire competitors.

The entire sector is under pressure to improve their financial performance and their acquisition skills. This must have been a chilly warning to smaller operators across the country, particularly the not-for-profits providers who are poorly equipped to compete. There are a multitude of consultants eager to help them for a fee.

No one is looking at the consequences for the residents or the staff who through no fault of their own are trapped in this roller coaster ride. Staff have to cope with a revolving door of managers, policies and corporate cultures.

The residents have no choice and no say in who will look after them as they are bought and sold with their nursing homes by aggressively competing companies that have to watch every cent if they are to survive.

The slide also shows that in 12 years, by 2028 the government will no longer be providing a buffer against unpredictable high aged care costs for most of us - only for the most disadvantaged. Those who are lucky to have a heart attack will escape but those with dementia who are in care for several years will pay for it all.

Our country is regressing from one where we care and are responsible for one another to one where the biggest and strongest fight with each other to survive and the rest are forgotten.

Update: September 2016 - The fly in the ointment

The problem in all this is that the government was forcing the seniors to fund all this by encouraging them to pay for their care by giving the companies large loans (RADs or Refundable Accomodation Deposits) which they were supposed to invest in new facilities, use the interest, and then refund the capital. Instead the companies used it to buy existing nursing homes initiating this feeding frenzy.

Prices rocketed and facilities and the residents in them were traded for much more than they were worth and more than the income they made could justify. It became a ponzi scheme funded by government. By September 2016 it had all come unstuck. Share prices have tumbled and so have the value of the assets that were purchased. An insightful analyst looked at the figures and predicted what was going to happen. His conclusion accurately sums up the problems when government trusts the free market.

Regulating a for-profit sector funded with public money is really really hard. It requires the intricate placement of carrots and sticks within the system to drive the right behaviour. It is further complicated by the fact that these carrots and sticks will inevitably spawn unintended second order carrots and sticks. Rest assured, free market participants will always find a way to dodge the sticks and feast on the juiciest carrots.

Source: RESIDENTIAL AGED CARE SECTOR REVISITED Find the Moat 29 September 2016

By the end of October 2016 the market had plummetted so RAD money is no longer adequately secured. Much of the Living Longer Living Better funding had evaporated together with the private equity investor, the founder and the CEO who sold up and departed when they realised what was going to happen.

The problem in this case is that the carrots are all inducements to do the wrong thing and there are no sticks. Markets are simply impersonal money making mechanisms and unless restrained and controlled will follow the money exploiting any vulnerability whether it is gullible and frail citizens or governments that live in an illusionary unreal world.

The problem for the Australian government is that there is now insufficient money to refund the RADs. The government have guaranteed them so they and not the companies carry the risk. Plans to get the industry itself to pay for insurance to cover the risks inherent in RADs were not implemented. That means that taxpayers are going to have to pay either by propping up these companies or by paying billions of dollars in bonds.

Linked pages in this section

The sections under the fold down sliders below give an outline of each of the linked pages.

The first four slider sections explain how this market works and how it impacts on care. It examines the risks for nursing homes residents, their communities, those that have no say in what happens to them, and to the system:

- Market processes in simple terms

- Private Equity

- Aged Care in the dark

- Risks in the marketplace. Who takes them and who pays?

Slider section: Aged Care failures following, describes how things went horribly wrong in a similar consolidating market in the USA.

Slider section: Competition on price and quality, I look critically at the myth suggesting that the sort of competitive consolidating market we are getting is about keeping prices down and providing good care.

Following this there is a slider examining some of the things that for-profits are doing that I find worrying. The slider after this looks at what some not-for-profits are having to do, or trying to do, to survive in this new high pressure marketplace.

Following all of this, I outline how the proposed hub will address these issues.

In When markets consolidate, the first of the last set of sliders I challenge those not-for-profits that think they can succeed in this marketplace by setting their ideas against the experience of other not-for-profit providers in similar markets elsewhere. I show how the proposed hub would help them by creating the sort of functioning market they think they are dealing with and where they can compete successfully.

In Prelininary thoughts about markets there is a brief look at some other aspects of markets and I talk about some of the illusions that underpin the way markets have been applied to aged care. This is something I will look at more closely on later pages.

Finally, in Thoughts about corporate care I give some more background information about the development of a corporate marketplace in health and aged care.

1. Market processes in simple terms

Being successful in a highly competitive market means making more money and spending less of it. This directly contradicts the claim that a market mechanism will keep prices down and improve care.

The stronger the profit pressures, the more competition and the greater the consolidation, then the greater the pressure to increase prices and reduce costs. It is the customer that gets in the way and stops this from happening. An effective customer makes the market work for the benefit of society and its members.

In a consolidating market, growth becomes critically important. Growth comes at the expense of someone else's failure and you don't want that to be you.

Growth requires an ever increasing income stream as larger and larger companies compete to acquire one another. This results in a spiral of increasing activity and ever greater pressure to perform by generating more income. These pressures come to control and dominate what happens leading to adverse outcomes. Anyone who gets in the way is dispensed with.

The linked page looks at the way capital is raised by loans or listing on the share market, the role of analysts in stoking the fire and increasing pressure in the pressure cooker. The page shows how this has become an exciting strategic game in which intense excitement and a high pressure builds up. Opportunities on the share market come in cycles so players need to plan strategically building income and capital. They must be ready and cashed up to seize the opportunities when the next feeding frenzy comes along.

The proposed hub is intended to change this game by changing the consumer, who is not-a-player, from a profit body whose passive role at present is to be squeezed and milked to provide the fuel needed to play the game. Instead, care of the consumer will be the object of the game and the player will only get further fuel if good care has been given. There is a giant warrior customer ready to wound or exterminate any player who transgresses. Success will only come by serving the consumer and satisfying the warrior that you are doing that.

Finally there is private equity, which increases the pressures in the system compounding the problems that this causes. At the heart of the problem in this high pressure game is the fact that profits and care come from the same income stream and in the absence of an effective customer the pressures for profit in the system far exceed those for care.

Learn more: To explore these issues and see examples see Market processes in simple terms

Back to top: 1. Market processes in simple terms Back to top of all sliders

2. Private Equity

The world of Private Equity (PE): This linked page explores the nature of private equity in greater depth. A paper from the United Kingdom based on interviews with five leading private equity partners provides a profound insight into this high tension, high profit, high risk financial market and the sort of people there. It focuses on the issue of trust and tracks this from the erosion of trust after the development of "New Capitalism" in the 1980s to a very different sort of trust in private equity. They call this "brittle trust" and compare it to the Mafia who operate in a similar high pressure, high risk environment. What the private equity partners say is illuminating and I ask how the care of the aged ever got caught up in all this.

Warnings ignored: The remainder of the page describes the warnings in submissions made to an Australian government inquiry in 2007. They ignored them. The evidence showing serious understaffing and poor care in nursing homes owned by private equity in the USA is noted. This was worse than all the other sectors and it grew worse the longer the homes were owned by private equity.

PE in the UK: I revisit the UK to record the ongoing problems with the UK's largest nursing home company Southern Cross after a private equity takeover by US private equity company Blackstone. The company that took over the nursing homes when private equity sold them is now also in administration as it is unable to pay its debts. Then there is Four Seasons, the UK's second largest (after Southern Cross) which has also been owned and operated by a UK private equity group, Terra Firma. It is now also in serious financial trouble.

Financialising: An UK analysis of the way private equity financialises its operations by having hundreds of companies all over the world shows how with each purchase or sale of a nursing home greater debt is incurred. The facilities are loaded with ever increasing debt and have to pay larger and larger amounts in interest. There is less money left to pay for the care of residents who suffer the consequences.

This is a carefully calculated high risk strategy. If they sell at the right time but leave the business heavily indebted they make a huge prophet but leave the buyer vulnerable. This happened in the UK with PE company Blackstone and the company it bought and sold, Southern Cross.

The investment is in serious economic trouble if the opportunity to list is missed, if income is impacted by an economic downturn or if there is a cut in government funding. The private equity firm has to accept its losses and get out as best it can trying to keep its losses to a minimum. This is what has happened with PE company Terra Firma and its aged care subsidiary Four Seasons in the UK.

Others follow the leader: In spite of this private equity is the most profitable investment for those with plenty of money. To compete for this investment other companies are increasingly behaving in the same way, adopting similar financialising strategies and getting into ever increasing debt. The whole market becomes unstable and at risk. This, as much as reduced government funding, is why the aged care sector in the UK is in such a chaotic state and care is so poor there.

Material from the USA reveals how other large for-profit chains are now adopting these same PE financialising practices and the consequences for care.

In Australia: On the linked page I look briefly at the way those in the marketplace in Australia and by implication our politicians think about aged care. There are a number of international PE groups that have owned and operated health and aged care businesses in Australia or who have tried or are still trying to get a foot in the Australian aged care market.

There have been two local Australian private equity companies that have bought and built up a large portfolio of Australian nursing homes. I do not know how financialised they are. The one listed on the share market at the right moment in 2014 and is currently doing very well.

The other seemed to miss the opportunity. The Australian government has started to cut back on the generous Living Longer Living Better reforms funding that underpinned the listing spree in 2014. There are reports of staffing cuts in its facilities and some suggestions that care is not what it should be. It looks like a replay of the Blackstone and Terra Firma saga in Australia.

What can we do about it?: The linked page echoes some articles in the UK by asking if private equity is fit to run our nursing homes. It emphasises what the costs for staff, residents and residents families have been and then looks at what the proposed hub might be able to do about it.

Learn more: To explore these issues and see examples see Private Equity

Back to top: 1. Market processes in simple terms Back to top of all sliders

3. Aged Care in the dark: Risks to the system

The linked subsection contains an explanatory introduction with summaries then links to four pages that explore issues in depth. The pages ocuments the many problems with a profit driven free market in aged care. They provide many examples, and then explore the underlying social structures and patterns of belief that gave rise to a belief in markets to show why it has become such a problem. It looks at how the proposed aged care community hub fits when viewed within the context of these insights. This slider summarises it briefly.

Policy in the dark: Australia’s aged care system fails to collect accurate data and as a consequence policy is made in the dark and is based on belief. But there is information available that indicates that the policy is wrong. These beliefs have been challenged and shown to be harmful. The policies that are being followed are being made in spite of the evidence and in the face of common sense. They are not serving the sector. The darkness is compounded by idelogical blindness.

Turning aged care upside down: The move from a not-for-profit dominated system to an externally imposed profit focused market has profoundly altered the way people think about aged care. While it claims to be going to do the very opposite, instead of the money following the needs of the customer the customer must still follow the money and take what it decides to give. Decisions are based on the money and in the promised future will be on the the choices the market choose to offer. The shift in focus away from the needs of the elderly has distorted the services provided.

On the linked page I look citically at the way the recent Living Longer Living Better aged care reforms were introduced without public debate so that critical issues about marketplace and vulnerability were ignored. The page looks at what we got and compares that with what we might have got.

Multiple examples are given that show how in a marketplace context patients in the health system and in aged have been harmed and their vulnerability exploited. The system itself has been exploited to make large profits. It is seen as legitimate to exploit any weakness in the regulatory system. This has been an ongoing problem in aged care in Australia. Politicians have cried fraud but they have themselves adopted these patterns of thought and have been similarly exploiting vulnerabilities that they have found in the political system.

An inappropriately organised system: The managerial culture that accompanied free markets, has focused on ordering, structuring and imposing processes that organise the system in a hierarchical manner that attempts to support and drive the market. It is ill suited to the sector, is rigid, process driven and inflexible so is unable to adapt to the needs of the elderly. The nature of the process acts as a barrier to the expression of our humanity and the empathic service that is required.

ACFI: The Aged Care Funding Instrument is a typical example. It is a complex and detailed centralised structure that attempts to control everything that happens. It is inflexible and does not serve those whose needs are not met by its structure. Instead of meeting its objectives it limits the provision of treatment that is needed and leads to treatment that is less effective. Its adoption of a model of managing decline has meant that treatments that improve function, enhance well-being and maintain capacity are not given.

It is trapped by the market system because it is already being rorted and any increase in flexibility will be exploited. It is suggested that a less structured locally controlled and managed system of funding that relies on people instead of process would be superior and more difficult to systematically rort.

Not-for-profit sector and the community: The introduction of a free market system has threatened the not-for-profit providers who have had to adapt to survive. They no longer have the same sense of mission and no longer support and maintain the values and norms that have kept the system on track for a century or two. The communities that once controlled the way care was given have been pushed aside as these communities have been “hollowed out”.

The focus on markets has led to a loss of stability and cohesion in society and this impacts aged care. The loss of the close links between the aged and community have impacted adversely on the relationships that residents form and their quality of life.

When things get bad: There are major risks to the whole aged care system when it is dominated by for-profit chains and is subject to market forces. In a market there are failures as well as successes. When nursing homes fail and have to close, it is the residents care that is squeezed to try to prevent failure. When a nursing home fails and is closed, they are the ones who are left homeless and dislocated.

When things are bad for one reason or another and good profits are not being made or when there is a boom in some other sector and more profits can be made there then for-profit companies will cut their losses and go elsewhere. They must serve their shareholders' interests first and they will move on leaving those they undertook to care for in the lurch. If there are enough of them the entire system can collapse. When the economy fails or government reduces funding then if they can’t abandon ship their primary concern is limiting their losses and that can impact on services.

Not on this page, but in the section on private equity earlier I described another example involving private equity Blackstone and Southern Cross the UK's largest nursing home operator. Southern Cross collapsed because of the way private equity played the game leaving Southern Cross so vulnerable that it went bankrupt. The residents were left in the hands of companies that built and rented facilities but did not normally run them.

The not-for-profits are there for the long haul. An ethic of service ensures that they will struggle on and eke out resources as best they can. When the for-profits cut and run, the remaining not-for-profits will have to pick up the pieces left by the fleeing for-profits - assuming there are enough not-for-profits left to do so after consolidation!. This is more than just conjecture. I illustrate this with examples from the UK, from the USA where the threat of this happening created major problems, and an example in hospital care from Australia.

Neutralising regulations: Two problem plagued large US health care companies entered Australia in the 1990s. Four state health departments regulating the health care sector were prepared to reject a company seeking licenses to operate hospitals on probity grounds. But only two states actually did so. In the two states, where the company owned a significant number of hospitals, politicians found ways to block their own departments who wanted to do their job of protecting the public by rejecting licences and closing the hospitals owned by one of these companies. There would have been significant inconvenience and political fallout if the hospitals had closed.

In the two states that acted the large company seen as a risk to the sector did not already own any hospitals. It was buying so no hospitals had to be closed or rescued by government.

The effectiveness of any regulatory action has to be set against the consequences of using it. When protecting residents means shutting down half the hospitals or nursing homes in Australia and throwing them out onto the street it simply is not an option. Once companies are big enough they can essentially do what they please and dictate their requirements. The consequences of stopping them once they have a monopoly are potentially disastrous. They don't need to buy politicians any more.

Exploring the belief systems in depth: In the final page in this section I look more deeply at the ideas underpinning society and democracy and the impact that free markets have had on both, on our humanity and on our capacity to empathise. I look at concepts like civil society, the common good, citizenship and social selves. The page looks back at some of the wisdom of the past. It examines the way we ignore established insights when we structure our world and develop ideologies. I examine the consequences of this for the way we behave.

I show how free market thinking has distorted society by selectivity and so shaped the dysfunctional aged care system that we have. I go back to the origins of the belief in free markets to show that its founding principles were based on the primacy of the interests of individuals making money and the view that social responsibility is a ”fundamentally subversive doctrine” and so had no place in the market. Contrary views, which argued that markets were about the customer, were simply ignored by the army of believers in what was by then an unchallengeable truth.

What is revealed: We are currently providing aged care to vulnerable people based on a system of thinking that at its heart rejects any form of social responsibility. This is hardwired into the structure of free markets. Even when its proponents profess to be socially responsible this becomes tokenistic. Companies that genuinely embrace social responsibility can not compete against those who don't - at least not until they have a monopoly, attained by not doing so, and can rest on their laurels. Is it any wonder aged care is not working?

Early critics argued that “the customer is the foundation of a business and keeps it in existence”. The proposed aged care hub is based on that insight. It seeks to create an effective customer to work with residents and family and by working together to fill that role.

Learn more: To explore these issues and see examples see Aged care in the dark

Back to top: 1. Market processes in simple terms Back to top of all sliders

4. Risks in the marketplace. Who takes them and who pays?

The linked page asks who takes the big risks in this sort of market. It is readily apparent that it is not the players in the game but the profit bodies. The players only lose money.

Companies are required to disclose risks to investors but not residents. They have no say in this. Worse still these profit bodies are traded in the marketplace with their nursing homes. A home with profitable bodies on beds will be more valuable. They are usually acquired by someone whose company is growing and believes that more money can be squeezed from their care.

'Choice' has little relevance or meaning when the most important choice - who is going to care for you and help you to die without suffering - is an empty one.

In a consolidating market residents are likely to find themselves sold off to someone whom they would never have considered as trustworthy under any circumstances. They have to suffer the consequences. The person whom those residents had trusted may have wanted to continue caring for them. Because this provider cared and employed more skilled nurses he was outplayed in the game and so had to sell to the highest bidder - the company that thought it could make the most profit.

Care is largely dependent on the number, training and motivation of nurses. Nurses salaries are the major cost in running a nursing home and the only way to reduce costs significantly is to reduce staffing. The rationalisations and excuses found for doing this are endless. The linked page examines this issue and gives examples. NSW has been the only state that has retained any minimum nursing level standards after all staffing requiremants were simply removed in 1998.

A bizarre rumour that the providers were lobbying politicans and that the NSW government had agreed to remove regulations requiring on site registered nurses in NSW has proved to be true. This is being done the face of massive opposition and an inquiry that not only advised against it but urged the federal government to legislate the same requirement.

The page looks briefly at who succeeds and who fails in this game and questions whether those who succeed are the people who should be trusted with our care - or whether those who fail in spite of their best efforts would have been better,

Learn more: To explore these issues and see examples see Risks in the marketplace

Back to top: 1. Market processes in simple terms Back to top of all sliders

Aged Care failures

The linked page describes the failures in care and the stress for residents and families when nursing homes have gone under and closed in Australia. But our market is still in its infancy. In the UK where private equity has played a large part, the collapse of large companies has seriously compromised care and created havoc. The USA has been doing this for many years and has been threatenned by the collapse of big companies. I explore the UK and the USA further on this page and give some country wide examples of what happened there.

Then there are examples in retirement villages like Village Life where the economic model was flawed and the low income retirees enticed into the facilities were left in the lurch. In others financial or other disputes can turn retirement into a nightmare.

Learn more: To explore these issues and see examples see Aged Care failures

Back to top: 1. Market processes in simple terms Back to top of all sliders

Competition on price and quality

Competition in a market system is claimed to keep prices low and also give good care. But all the pressures in the system are to increase prices and to compromise care in order to keep costs down. In the absence of an effective customer, the pressures in a strongly competitive system can rapidly overwhelm the consciences and best intentions of participants.

How they respond to situations like this and the reasons for this are discussed on subsequent pages. But ultimately the pressures of the market dictates the conduct required and those who do this succeed. The consumer's suffer the consequences.

On the linked page I explore some facets of this and then give examples where the market has been manipulated, vulnerable sectors and vulnerable people rorted and where collusion has occurred. The examples come from health and aged care. In all of these instances vulnerable people were the victims.

Detecting and prosecuting these things is difficult and too often is possible only because the participants persuade themselves that they are not doing anything really wrong and don't hide it. I argue that these are red flags and this happens far more often than we realise.

While collusion is usually at someone's expense, a certain amount of implicit collusion between providers is involved in developing a stable market that works for all parties - one that gives reasonable returns on investment and effort while providing what the customer requires.

I argue that it is unspoken collusion between the providers and the customers that gives rise to a stable market, one that works for all parties. In a functioning market the trade in goods and services works because the level of competition is muted and no longer damaging. Everyone can get on with their lives in a sensible way. A sufficient number of goods and services is provided to meet society's needs at a cost that they can afford and at a profit which makes it worth while doing.

Excessive competition drives deceptive marketing in an attempt to create a demand that is not beneficial for society. It distorts society and impedes its ability to function effectively.

Learn more: To explore these issues and examples see Competition on price

Back to top: 1. Market processes in simple terms Back to top of all sliders

Issues relating to the way for-profit providers operate

The linked page examines the issue of betrayal of trust when big companies that we consider to be pillars of society are caught in the pressure cooker of the market. It looks at the banks and the most recent of the many frauds that they have indulged in to show what can happen. Next, it examines Dr Richard Baldwin's findings when he researched the impacts of competition and a for-profit corporate structure on staffing and on care outcomes internationally and in Australia.

Deception: To explore tendencies towards dysfunctional conduct in aged care in Australia I start by looking at a case where a judge reached disturbing conclusions. A doctor had rented a nursing home he owned to a consortium of FPCompanyK (a subsidiary of a bank), FPCompanyL Healthcare and FPCompanyG with a contract that he had the option of asuming management of the operating nursing home on expiry of the lease. He was prevented from taking over and operating the nursing home as the consortium closed it behind his back before handing it back. He went to court and won.

What is particularly disturbing is the culture that was revealed in these organisations by the evidence, the lack of integrity and the lengths they went to. The court found that they deceived the doctor, the nurses in the nursing home and the residents.

The residents' interests were ignored as they were pressured to agree to what the companies wanted them to do. The providers breached their contract with the doctor and pressured the residents to leave, urgently closing the nursing home before the doctors could stop them. Most residents were transferred to empty beds in their own homes, presumably in order to block this competitor and keep the profits from their care.

Hiding your past: I noticed that a retirement home operator was promoting a money making model to investors. This was a model that had previously failed on the share market. It had been strongly criticised not only for losing money but for ejecting a large number of retirees leaving them in the lurch. Seven years later and analysts were being positive about this apparently, new venture and it was raising money.

When I tried to find out who this company were, a name rang a bell. I looked back at my old web pages and discovered that it was the same company that had simply changed its name. It was now selling what I consider the same model that had previously been so enthusiastically embraced, and so many, including the banks had lost money on.

Anyone who did not know the original story would have been unaware of this. Analysts either did not know, or else were complicit in not mentioning all this in their analysis of prospects. I wondered what it was trying to achieve and who was actually going to be the winner and who the loser this time around.

Preparing for float: Finally, there is the example of a company where two patients have been cooked to death over several hours in recent years. There were allegations in both instances that there were too few staff there to see what was happening. There was nobody watching the residents because of massive staff cuts. The unions have come out particularly strongly in this case claiming that the company is preparing to float on the share market and has been systematically reducing staff in order to boost profits so that it can do so. My experience, from seeing how the unions behaved in the USA, is that they would not speak so strongly without good reason. The coroner's comments will be of interest when the most recent case is considered.

Luxury homes: The target of a market is people who will pay well - the wealthy. Those seeking large profits are building luxury holiday resorts for the frail elderly. But the vast majority of nursing home residents are now far frailer than they used to be and less able to embrace all this luxury. There is a greater need for good staff and good care which are both costly and cut into profits. The issues raised about this is the possibility that these facilities can become all show and no care. This is hinted at by some and sometimes alleged by family or friends.

Learn more: To explore these issues and examples see For-profit operators

Back to top: 1. Market processes in simple terms Back to top of all sliders

Not-for-profit operators in an aggressively competitive market

Not-for-profit operators come from a sector with very different ways of thinking, one where cooperation and a focus on care is paramount. They are now being forced to compete in a market where profitability and growth are the markers of success. Dr Baldwin has pointed out that for-profit companies are more able to raise capital than not-for-profits. In a consolidating market not-for-profits are disadvantaged. Even though not-for-profits provide better care it is the for-profits that will succeed and dominate, which is what has happened in the USA. This page looks at some of the difficulties for the not-for-profits and the strategies that they are using in an effort to compete.

Sponsorship problems: One strategy is to partner with a for-profit provider that is doing well in the marketplace. Alzheimer's Australia seeks sponsors and welcomes for-profit providers. It works with them to train staff and support their operations in caring for dementia patients. It is not particularly choosy in accepting some sponsors with a poor record, presumably aiming to improve their performance. Their money enabling the good work they do comes from government and industry, both bodies that are promoting this market.

Many in the industry have persuaded themselves that care can be provided with fewer staff. They regularly try out new staffing models. One of Alzheimer's major sponsors in Victoria is the company cooking the residents whom the nursing union accuse of firing staff in preparation for an IPO. Alzheimer's is helping them train staff and provide care to dementia patients. It cannot be unaware of this if it is happening. If so, will it speak out and alienate all of its sponsors and funders or will it be complicit and go along with this? Will it be a party to it?

Marketplace appointees and for-profit partners: Not-for-profit NFPCompanyM has appointed a new CEO with extensive experience in growing companies in the marketplace. It has then formed a business alliance with a for-profit market listed real estate investment trust (REIT), Generation Healthcare. The focus of the alliance will be growth with Generation Healthcare buying the buildings and NFPCompanyM operating the nursing homes. Generation will be raising the capital needed to grow the business from the sharemarket. NFPCompanyM will run the nursing homes so piggy backing on Generation's access to market capital. NFPCompanyM has also merged with another not-for-profit, NFPCompanyß so making a larger, stronger and more competitive company. Will they look at opportunities created in Asia by trade agreements.

Copying for-profits: NFPCompanyN has decided that if you can't beat them, then copy them. Mxxx Mxxx's for-profit group is building luxury facilities for the very rich and NFPCompanyN has emulated it by developing a luxury hotel style facility. It is trying to hold on to its mission by also offering care in the facility for the not-as-wealthy. The tradition of the rich supplementing the care of the poor is a long not-for-profit one. The worry is that this may mean that NFPCompanyN is competing with one hand tied behind its back.

Managing like a for-profit: NFPCompanyE in Queensland has been accused of failures in care. NFPCompanyE strongly denied most of the allegations alleging that it has been unfairly treated. It lodged an appeal against the decisions made by thye quality agency and won the case. It was apparently very profitable and I wonder it may have attempted to emulate the for-profits by increasing efficiency.

A facility owned by NFPCompanyX has been accused of excessive of serious deficiencies in care and one wonders if this is what happened there.

Defensive not-for-profit partnerships: Another strategy is for not-for-profits themselves to consolidate. Two large companies are doing that in order to make tyhemselves more competitive. The strategy has also been adopted by a community, whose nursing home is no longer viable under recent government changes. It is determined to maintain a not-for-profit service. Overtures from for-profits have been rejected and it is partnering with a nearby not-for-profit that fared better and together they hope to resist the onslaught.

Rationalising or getting out: Some are rationalising their services, jettisoing those that are not profitable. Others either have no stomach for this, or realise they will not be able to compete in this sort of marketplace. They are selling up and directing their attention elsewhere.

Learn more: To explore these issues and examples see Not-for-profit operators

Back to top: 1. Market processes in simple terms Back to top of all sliders

The role of the proposed Community Aged Care Hub

On the pages above I analyse this marketplace as a 'game'. This is a common metaphor used by journalists analysing this sort of consolidating market (mergers and acquisitions). The reason why it is so essential that the Community Aged Care Hub and its central body have representation on the federal body approving prospective owners for each nursing home, built, bought or merged, is that the community should take control and set the rules for the 'game' so that it benefits them as well as the providers.

Control: To make this market work, the community hub must have control of the market. It is the representative for present and future residents. As such it must ensure that those frail elderly that the hub is supporting and protecting are not caught up in these market shenanigans. The hubs need to ensure that those they are responsible for will be cared for by people they can trust. Market theory as expounded by Adam Smith, the father of market theory, over 200 years ago, tells us quite clearly that this is what must happen if the market is to work.

Instead of frail older members of the community being 'profit parcels' (consumers) traded on the market, they will be assisted by the community and together with the community they will become the customer who controls how the market operates and ensures that it works for them.

Making theory work: That is how market theory tells us it should work and provided the customer has the knowledge, the power and the will it can make a big difference. Having the power to decide who will provide care in your community is critically important. We can speculate that we could have had an even better system if we had started by planning sensibly, but that is now immaterial. We have to make do with what we have got and make this thing work.

Choice: Government and industry in Australia are currently vocal in promising our elderly another set of illusions. They are being offered 'choices'. The opportunity to choose from the many services providers think will be profitable for them to offer.

The proposed Community Aged Care Hub offers them the one choice that they really need, and nobody is really offering. This is the information and the help many need to make the choice of who cares for them, what care they choose, and control of the care that is provided. That is what is going to have the greatest impact on their lives.

On the web page Aged Care Roadmap in the Introduction section there is a table comparing the system we currently have with the sort of system the Community Aged Care Hub that we are proposing is intended to create.

When markets consolidate

I wrote the linked page as a direct challenge to Sxxxxx Jxxxx, who runs a successful faith based not-for-profit company. I like what Sxxxx says most of the time and agree with him. Sxxxxx has written a blog about the new competitive market and I think he is being starry eyed. He considers that mission is important (I agree) and that the mission can survive and not-for-profits can prosper and preserve their mission by attention to price, quality and by looking at niche markets in the sector. I disagree.

On this page I challenge Jxxx's ability to do this by setting his ideas against what happened in the USA and the statements made by not for-profits there when the US health and aged care sectors went through this consolidation phase. Not-for-profits were gobbled up very rapidly. I suggest to him that what he needs to do is to support the idea of a Community Aged Care Hub, because this will turn the aged care market into the sort of market he is talking about - one where good care and value for money will have a competitive advantage. Not-for-profits that we already know provide better care will have the competitive advantage that good care provides. It will be the for-profits that have to match them to succeed. I am offering him a lifeline if he wants to grasp it and help get this going.

Learn more: To explore these issues and examples see When markets consolidate

Back to top: When markets consolidate Back to top of all sliders

Preliminary thoughts about markets

On this page I reflect again on the pressures for-profit and the role of advertising in this system. I look at what happens when governments give companies a blank cheque and do not require them to be accountable for what they do with the money or for the product they provide. Finally I introduce some thoughts about the illusions that underpin the current system. I look briefly at the illusion, in the face of evidence, that the market has no adverse impact on care and at all the hype surrounding the focus on key personnel rather than owners. I will write more on later pages.

Learn more: To explore these issues and examples see Some thoughts about markets

Back to top: When markets consolidate Back to top of all sliders

Background to corporate care

On the linked page I explain how my earlier illusions about the benefits of corporatisation were shattered and quote two of the leaders in the USA to show why. I look briefly at the illusion of claims to efficiency and then look at why politicians find the snake oil promoted by corporate conmen to solve their difficult problems and sooth their pain so irresistible.

I look at how early critics in the USA were ignored and at the sort of road forward that we would have liked to have followed at that time. But it is much too late for that now.

The proposed Community Aged Care Hub is an attempt to address the problems that we have now and to create a context within which more sensible policies can be forged into the future if this does not work. It is important that when changes don't work we know that they are not working and can do something about it. That is what has been lacking in our current system.

The hub will collect the information that will give an early warning. We cannot allow a failed system to operate for 19 years before we do something about it ever again - all just because some powerful people need to maintain the illusion that it is working so refuse to listen to their critics.

Learn more: To explore these issues and examples see Thoughts about corporate care

Back to top: When markets consolidate Back to top of all sliders