The Australian Government set up the Aged Care Sector Committee in April 2015. It was tasked with the creation of a 'roadmap' for the progression of the market driven and controlled, and centrally structured and organised Living Longer Living Better (LLLB) aged care reforms that were passed into legislation on 26 June 2013.

The argument is that the LLLB reforms are conceptually flawed and based on outdated and inappropriate thinking. This is reflected in the Aged Care Roadmap published in March 2016. Because of the many perverse incentives, it will be difficult, if not impossible to achieve its lofty goals. Its policies are being imposed in the face of evidence that vulnerable people are at risk and that care will be compromised by the sort of marketplace that is being supported.

Background information

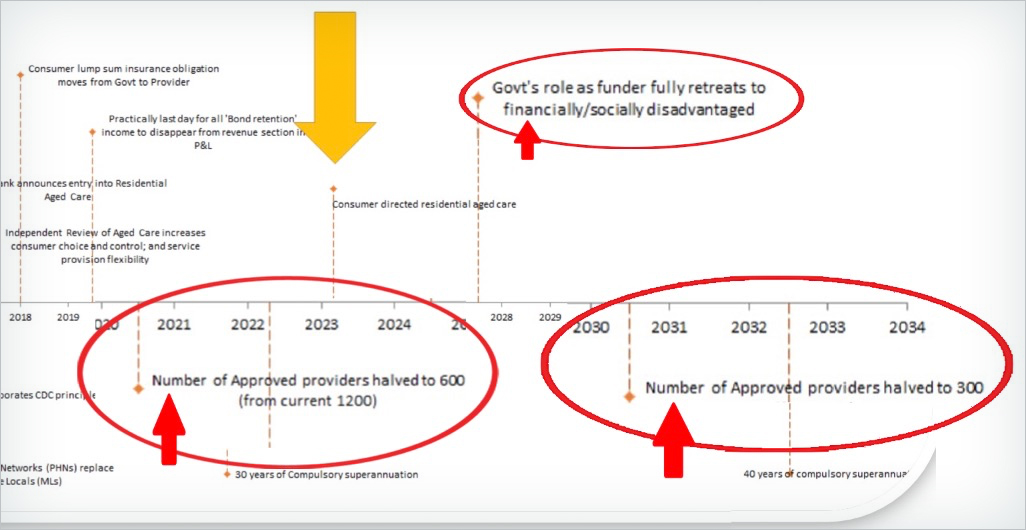

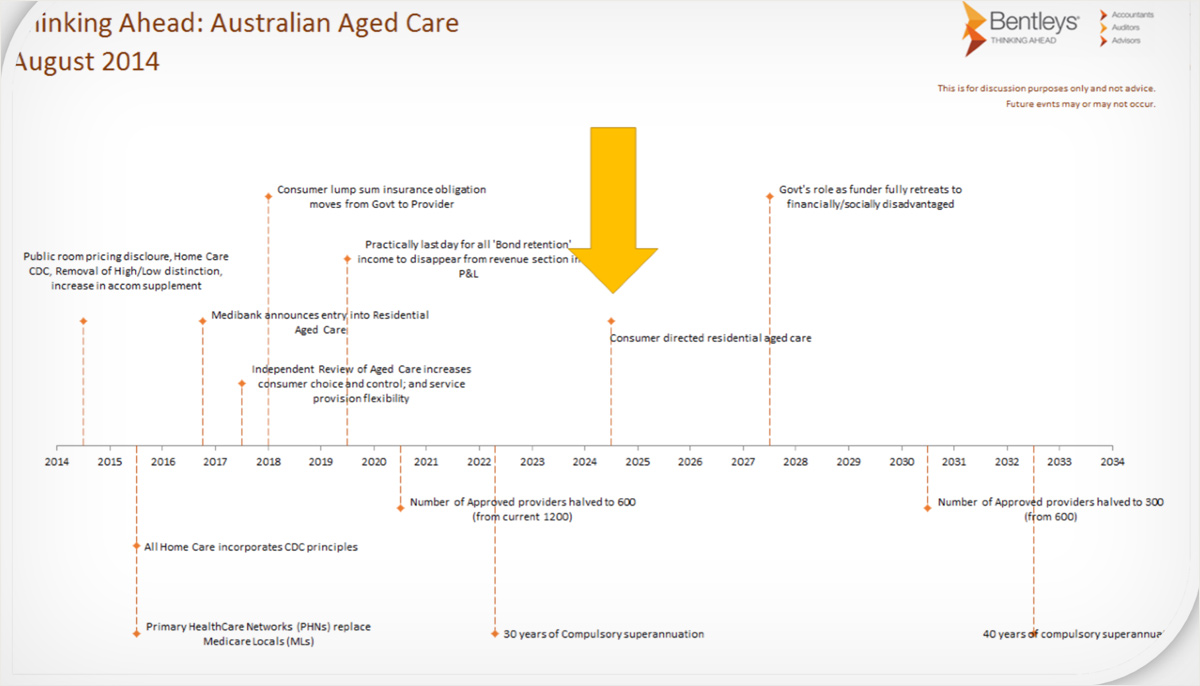

The industry particularly the National Aged Care Alliance has been involved in developing the government's roadmap. Senior industry executives have held government appointments and been consultants and advisers.

But the government's glowingly presented and marketed roadmap built around a competitive market that will give us choice is not the only roadmap. These senior executives seem to have a very different looking roadmap of their own that paints a very different picture. Aged Care Crisis is suggesting a Community Aged Care Hub as a third much better roadmap for Australia and its citizens.

Tip: Click to expand (+) or collapse (-) content on this page

The Government's Aged Care Roadmap

Claim: The roadmap indicates that this is "A single aged care and support system that is market based and consumer driven, with access based on assessed need". Services will not be regulated but left to the market. It claims that "the market determines price".

But without an effective customer, a system where the market runs the show and determines price cannot be "consumer driven. This will not contain cost blowouts for consumers who will be at risk of exploitation.

Claim: "Consumers will be viewed as active partners throughout the care journey".

But without addressing the power imbalance, this will be at the discretion of the marketplace.

Claim: The roadmap "gives providers freedom to be innovative".

But it does not give the community the same freedom. Innovation is likely to be of benefit for providers rather than consumers.

Claim: "Contestability of delivery will promote quality, productivity, efficiency, innovation and value for money services that are responsive to consumer needs and preferences," is enshrined in the Aged Care Sector Statement of Principles. That comes straight out of some free market handbook.

But contestability requires a knowledgeable and powerful customer. It requires the proposed Community Aged care Hub if it is to work.

Claim: "... a light touch approach to regulation will give providers freedom to be innovative in how they deliver services." This is also from the Aged Care Sector Statement of Principles - another bit from some free market handbook where it is called "liberalisation".

But this requires an effective customer and an active and involved civil society. What is needed is effective low impact on site regulation like that proposed for the hub. As many examples show, in an unregulated free market context corporations find innovative ways of serving themselves rather than customers, and then justifying this to themselves. I look at this and give many examples on three web pages in the section Cultural perspectives.

Claim: "Consumers will drive quality and innovation by exercising choice as to which provider/s they use" and "packages are portable."

But the elderly seek stability, known faces and a known environment. They are easily disoriented by change and rarely exercise this choice. Furthermore, their ability to port to another provider when they have been sold snake oil will be discouraged because, as is reported on Australian Ageing Agenda, "exit fees (are) charged when a consumer switched providers or left their package". That information will not be publicly available when they first choose a provider.

Claim: There will be a strong focus on positive images of aged care.

But "positive images" should be read as advertising and a continuation of the present deceptively positive advertising. This is the medium for selling snake oil. What prospective residents and family needed is the data that the system does not collect or publish and assistance from a knowlegeable and trusted personal empathic support system.

Note that: The philosophy underpinning the policies of this roadmap is the free market neoliberal Friedman/Reagan/Thatcher philosophy that saw social responsibility in the marketplace as a "fundamentally subversive doctrine". In free market thinking, the responsibility of managers is to shareholders and not primarily to customers.

But free market thinking turned established market theory on its head by shifting the focus to shareholders. It disregarded the central role that an effective customer plays in making markets work and that civil society plays in setting parameters. Under the guise of competition and efficiency it promoted a one size fits all centrally organised and structured approach to managing any system.

Impersonal process constrains our ability to express and engage our humanity. Aged care is a sector where this sort of engagement is essential. As a consequence of this sort of management, local communities (civil society) have been "hollowed out", losing involvement, knowledge, confidence and so the ability to play their important role in capitalist democracies - in this instance, in aged care.

Vulnerable customers are not protected and so are readily exploited. Information is tightly controlled with little transparency. Citizens are no longer able to fulfill their responsibilities to society so disengage from the plight of others. Market entities control politics as well as the thinking of a passive community that is not engaged with issues such as aged care.

The argument is that the lofty goals the Aged Care Roadmap claims are not attainable within the patterns of thinking on which it is based and with the structure that has been set in place. In almost every free market sector where customers are vulnerable they are at high risk of being exploited. There are no reasons to think that aged care is any different. In the section 19 years of care I give links to material describing many red flag examples that suggest this is already happening.

Comments made in rersponse to an article about the roadmap on Australian Ageing Agenda show that others are as sceptical as I am.

- Aged Care Roadmap: what will aged care look like in a decade? Australian Ageing Agenda 13 July 2016

A Different Aged Care Roadmap

Aged Care Crisis is supporting a different community based and structured model for the provision of aged care - a more sensible "roadmap" for the future. It complies with market theory and removes the perverse incentives in the market. It offers a much better way of attaining the lofty goals and dealing with problems that already exist. It seeks to change the administrative and management structure of aged care in such a way that the unequal balance of power and decision making is addressed. Control will be shifted from market to customer and community - a necessary condition for market theory to work.

By changing the context it eliminates the perverse incentives. It is not a radical reform, but a considered step like process that can be introduced and built in stages. On this website I am arguing against the LLLB and government roadmap and in support of a community based approach to aged care.

The following table summarises the essential differences between the LLLB proposals as represented in the roadmap for introducing them and the proposed community based aged care hub alternative. The marked info links in the table (below) when clicked on, display additional information which expand on the related cells content.

|

Dimension |

Government Aged Care Roadmap |

Aged Care Community Hub Roadmap |

|---|---|---|

|

Structure |

Hierarchical top/down info |

Local bottom/up info |

| Staffing of regulatory system |

Central info |

Local info |

|

Philosophical underpinning and organisation |

|

|

| Funding |

Centralised, structured, rigid, unresponsive info |

Managed locally, less structured, flexible, responsive to need info |

|

Consumer/Customer/family |

|

|

|

Community |

Absent or peripheral. Involved only by invitation. |

Central to the organisation and management of regional care. Significant power. info |

|

Regulation: |

Central, infrequent oversight and very occasional visits |

Local and at the bedside with central support and backup when needed. |

|

- Data collection |

Very little if any – 3 to 5 yearly accreditation visits |

|

|

- Accreditation |

|

|

|

- Complaints |

Distant, complex, process driven, delayed and ineffective |

|

|

Advocacy for individuals |

Commonwealth contracted to states. Conducted mostly by phone |

Local, directly available and supported by central service. |

|

Visitors system |

State run |

Integrated and coordinated locally by the hub |

|

Community aged care activities |

Fragmented |

Integrated and supported |

|

Providers |

Currently customer beware and distrusted |

|

| Advisory role |

|

Hub assumes advisory, information and support role based on local knowledge as well as national data. |

|

Consumer feedback |

Dependent on commercial market and various website systems that are easily gamed. |

Collected personally or else controlled by the hub which would select and work with a web based feedback service so ensuring adequate numbers and avoiding gaming of the system. |

|

Advocacy for aged care |

|

|

|

Policy Development and innovation |

Government, and corporate executives. Market driven. |

|

|

Introduction of changed system |

LLLB changes were not trialed and were simply imposed across the country in final format with fanfare. |

|

|

Research |

Arranged with provider |

|

|

Case management and assessment |

Providers manage cases creating conflicts of interest |

Hub controls or contracts for case management and assessments. |

|

Costs |

|

|

|

Competition |

|

Controlled and based on the service actually provided to the customer who is supported by the community. |