The Australian Government set up the Aged Care Sector Committee in April 2015. It was tasked with the creation of a 'roadmap' for the progression of the market driven and controlled, and centrally structured and organised Living Longer Living Better (LLLB) aged care reforms that were passed into legislation on 26 June 2013.

The argument is that the LLLB reforms are conceptually flawed and based on outdated and inappropriate thinking. This is reflected in the Aged Care Roadmap published in March 2016. Because of the many perverse incentives, it will be difficult, if not impossible to achieve its lofty goals. Its policies are being imposed in the face of evidence that vulnerable people are at risk and that care will be compromised by the sort of marketplace that is being supported.

Background information

The industry particularly the National Aged Care Alliance has been involved in developing the government's roadmap. Senior industry executives have held government appointments and been consultants and advisers.

But the government's glowingly presented and marketed roadmap built around a competitive market that will give us choice is not the only roadmap. These senior executives seem to have a very different looking roadmap of their own that paints a very different picture. Aged Care Crisis is suggesting a Community Aged Care Hub as a third much better roadmap for Australia and its citizens.

Tip: Click to expand (+) or collapse (-) content on this page

The Industry roadmap

The industry has been looking at another roadmap, a roadmap that reveals what the governments roadmap and intentions may mean for them.

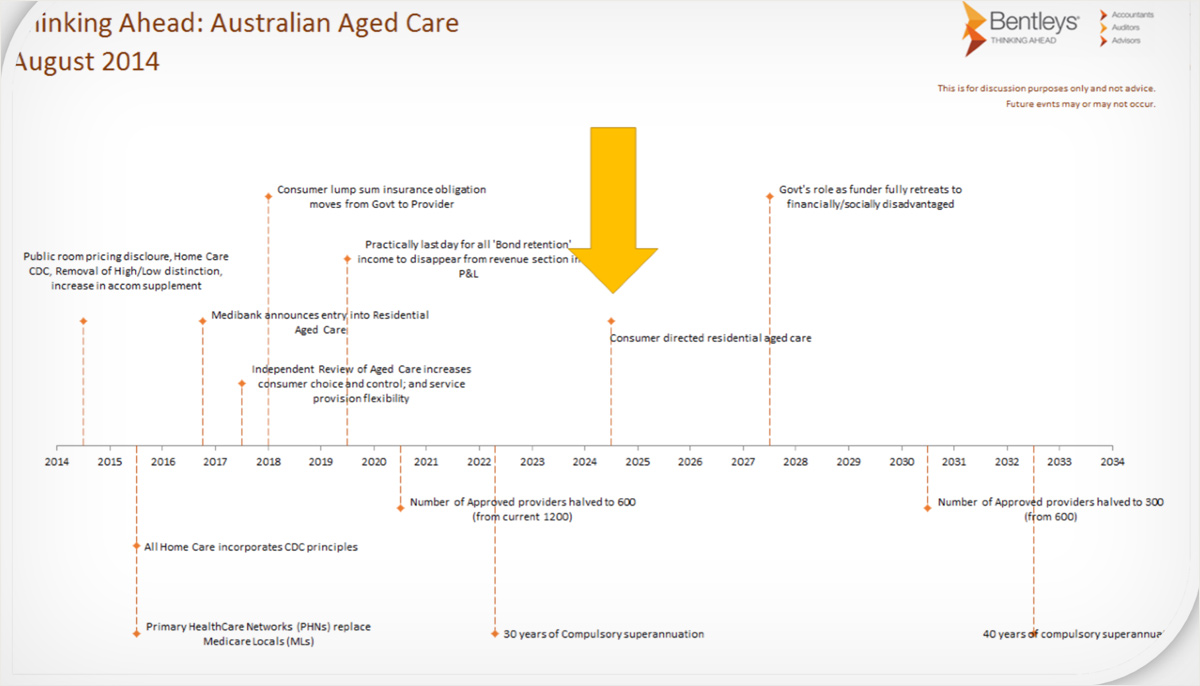

Bentley's is the company that reports annually on the aged care sectors financial performance so is well informed about what is happening in the sector. We do not know if the figures they give are based on government projections given to the many industry representatives who were part of the consultation process. A Bentley's presenter was a speaker at both LASA and ACSA meetings in 2015. LASA is the body representing the whole industry. ACSA represents the not-for-profits.

We don't know exactly what was said so it is not clear whether the figures given represent the real agenda and intent of government or the industry's projections of what is going to happen*. Either way they are alarming particularly for not-for-profit providers and smaller for-profit providers. Perhaps Bentleys were deliberately painting armageddon for the industry or setting out a worst case scenario to encourage them to spend money on consultants. Either way it tells us something about the pressures being introduced into the system and what we might expect.

(*The slide contains the following statement "This is for discussion purposes only and not advice. Future events may or may not occur")

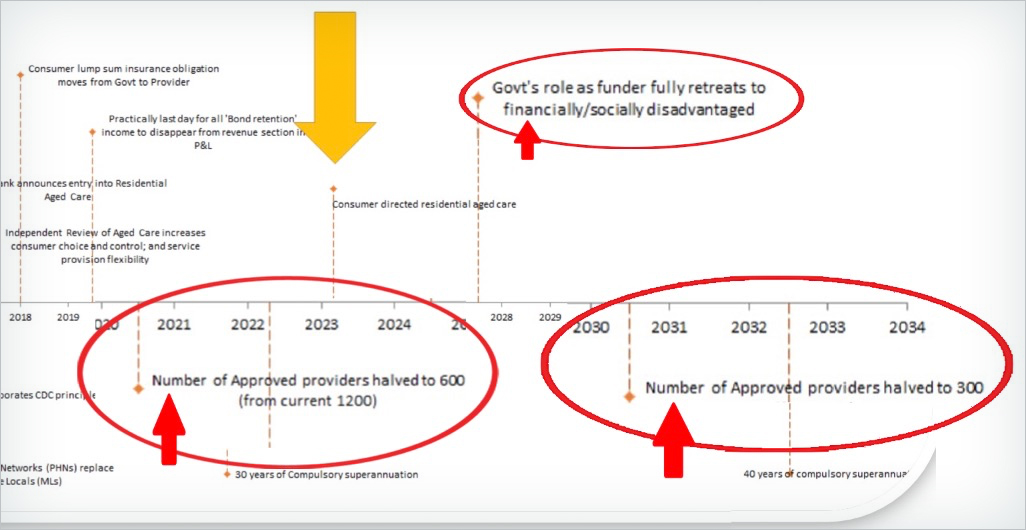

One of the slides shows a timeline. This predicts that consolidation of the market will halve the number of approved providers in the next 6 years (from 1200 to 600 by 2021). In the subsequent 10 years the numbers will halve again (from 600 to 300). So by 2031, 16 years time, only 300, one quarter of the current providers will still be in business. The remainder will be acquired or put out of business.

At a time when we are facing a massive aged care bulge this is a massive turnoff for those who are motivated to help us solve it by opening nursing homes. What we need in aged care is people who are motivated to care. It might pull in those eager investors who think they can build a nursing home cheaply and then flog it off at a huge profit, but are those the motives or the people we want to encourage.

Consider the following issues:

- How many of those who are motivated will enter a marketplace where they have to compete with aggressive profit hungry giants who are going to try to put them out of business or acquire them.

- How many will be in a position to spend more money on staffing and improve care beyond the absolute minimum.

Note that the timeline suggests that Medibank might enter aged care in the next few years. It also indicates that within 3 years government will stop guaranteeing to repay bonds when companies go under and can't pay. The industry is going to have to insure for this themselves. Imagine the premiums that providers will have to pay in a high risk marketplace where three quarters of the players will be gone in a few years. The temptation to prop up their finances with bonds rather than secure them will be irresistible.

Those extra premiums will mean that residents will have to be charged more in order to cover them. That will not worry government because they are going to steadily reduce the contribution that the taxpayer makes to aged care payments. By 2026, in 12 years time only the most financially/disadvantaged will get help in paying for aged care.

The Industry's contribution to the government's roadmap

The ties between government and industry: The industry's contribution to the governments roadmap through NACA (National Aged Care Association) is a long one. It started with the joint development of the Living Longer Living Better (LLLB) program. This was based on the recommendations of the 2011 Productivity Commission Report "Caring for Older Australians". In addition individual members of the industry consulted and worked closely with government. They were appointed to government bodies.

The contribution that one senior member of the industry Pxxxx Gxxxx made to the development of policy is illustrative and instructive. He was the long time Australian CEO of INTFPCompanyB, a UK based company that has been in the headlines because of problems in care across its operations in England, Scotland and Ireland. It has also had some problems in Australia.

The industry in the UK is in dire financial trouble at the moment. Unlike the not-for-profits which are there for their residents for the long haul, the for-profits who are there for the money and not for society are selling up and getting out as best they can. INTFPCompanyB has already sold off its home care division and is rumoured to be doing the same with nursing homes.

Gxxxx was appointed by the labor government cabinet as an independent expert for the Aged Care Financing Authority (ACFA) in 2012. During this period the ACFA submitted "Final ACFA advice on setting accommodation payments in residential aged care to the former Minister on 28 November 2012." This advice set out the framework for setting accommodation payments in residential aged care. Additional advice on RAD and DAP payments was given by ACFA on 17 May 2013 before Gxxx resigned in May 2013.

- 2012-13 Operations Report of the Aged Care Financing Authority DSS web site accessed 31 Oct 2016

Later as the inaugural chair of The Aged Care Guild, the powerful group formed by the largest few providers to protect their interests, Gxxx advised the Australian Government on the Living Longer Living Better aged care reforms.

In 2014 when Private equity company owned FPCompanyI listed on the sharemarket Pxxxx Gxxxx took the job as its CEO. It performed brilliantly, was profitable and grew rapidly by buying competitors. The sharemarket and its investors were ecstatic.

When things come unstuck: In 2016 the bubble burst when there was a massive blowout in government funding. The government accused the industry of rorting the funding system. The industry prefered to call this maximising, which was not illegal. The government blocked the loopholes and the market collapsed with FPCompanyI in the most trouble. It seems likely that FPCompanyI, whose CEO had been the expert advising the funding body in setting up the funding model, was the prime offender in maximising and this was the reason for its success.

In May 2016 after allegations of industry "rorting" were first made the private equity group that had floated the company in 2014 sold all of its remaining shares. When the impact of the restriction on maximising for FPCompanyI became obvious its original founder, Pxxxx Axxxxx sold his entire stock and resigned as director leaving remaining shareholders "ropeable" (according to the Financial Review). Gxxxx resigned two weeks later.

- UBS sells balance of QXXXX's stake in FPCompannyI Health Australian Financial Review 9 May 2016

- FPCompannyI Health gets a not so fond farewell from Pxxxx Axxxxxx Australian Financial Review 31 August 2016

- FPCompannyI Health CEO Pxxx Gxxxxxxn departs after shares lose 50pc in nine months Australian Financial Review 16 September 2016

The remaining shareholders were left with the losses and the residents of the nursing homes with the consequences. These canny businessmen got out quicker and more successfully than INTFPCompanyB had done in the UK. Goverment are left with egg on their faces and will have to bail out the company to protect the residents. Some facilities are already having trouble with accreditation.

This is shrewd and ruthless business by experts in the field. In a competitive market others must follow to remain competitive. Once someone does something "innovative" like this others must follow. Soon almost everyone is doing it. I am not suggesting that anyone did anything illegal but it does illustrate the way the marketplace that the government has so much faith in operates. The government is basing the success of its roadmap on this marketplace and entrusting the care of our vulnerable seniors to it. Will this market treat us all in the same way when we are old and will the government then have to support them to prevent them from walking off and leaving us without care?

Policy issues: As a community we should be very concerned about the close links between governments and senior executives from big corporations when developing policy in vulnerable sectors. It is clear that these relationships are unhealthy. The primary objectives of the big for-profit enterprises are not aligned with those of the sector or the community it serves so they are not there for the long haul. They are not in the best interests of the sector or the community and readily abandon both.

Prospective residents and their families are easily persuaded by glossy brochures and web sites with photos of impressively welcoming executives.

The government is selling those needing care "choice" as if it is a golden opportunity. It is giving these company's their stamp of approval by listing all their facilities and their services for families to choose from on the Myagedcare web site.

Trusting families see them as approved and so safe. They readily choose these facilities and place their trust in these businesses. Not only does research indicate that these companies are on average more likely to have failures in care but they may not be there for the residents when the going gets tough.

Commissions, incentives and the vulnerable

The roadmap fails to confront the trusting nature and the vulnerability of older Australians. People expect those providing health or aged care services to them to have their interests at heart and not to be there to bilk them.

Kickback schemes are illegal in healthcare across the world and yet there have been endless ways of finding some legal or difficult to detect path around the regulations and it is usually the bigger corporations that are most at fault. At the heart of the majority of the massive corporate frauds and the harm done to patients in the USA that I studied have been a variety of incentive and kickback schemes. They may be illegal for doctors but they are nor illegal for the many layers of management that increasingly control medical practices.

Vulnerable consumers in several sectors and particularly the elderly are being defrauded for example in audiology. One elderly person offered a hearing aid for $10,000 was able to buy it elsewhere for $3000. The Australian Competition and Consumer Commission (ACCC) has been investigating this and reporting to the HOUSE OF REPRESENTATIVES STANDING COMMITTEE ON HEALTH, AGED CARE AND SPORT inquiry into Hearing health and wellbeing in Australia on 23 March 2017. Hansard

The ACCC witnesses were Mr Richard Fleming and Mr Scott Gregson

Their warning was general but was also directed specifically to the risks this might impose for the NDIS (National Disability Insurance Scheme) which is to operate in much the same sort of market as that planned for aged care in the roadmap. The same providers will frequently serve both markets. It is equally applicable.

The hearing was into the impact of these commercial practices in audiology – particularly hearing aids and the main customers of these are the trusting elderly. When confronted with this issue the government's response is always to talk about consumer education and more information. The ACCC clearly indicates that is not effective.

The issues the ACC drew attention to were

(1) sales that may be driven by commissions or other incentives rather than consumer need,

(2) cost and performance of hearing aids and

(3) the treatment of vulnerable consumers.

Note that it is the bigger companies that are most at fault and these companies consider that these practices are a normal part of business and part of a market economy.

EXTRACTS

Mr. Gregson: - - What is clear is that commissions, incentives and interest on targets are quite pervasive in the industry, - - (later )- - - - - - - the issues of concern followed the size of the players. - - - some clinicians are offered performance rewards like overseas travel.

- - - we have made it very clear- - - through changes such as the NDIS that they need to be conscious of these issues - - .

- - - To some extent the concerns we have about sales practices driven by commissions and incentives lead to the third category of dealing with vulnerable consumers, and indeed we think can lead to the provision of either inappropriate devices or overselling or upselling to devices that may not be necessary. That is the evidence that came through.

Mr Fleming. - - - - the pressure on clinicians was there to sell hearing aids, and that is a significant pressure - - - they were overselling, upselling and focusing on that rather than caring for the clinical needs of the consumer.

Mr Gregson: - - - being upsold products—and not always the best suited product, and there is a financial cost involved—but there is also access to finance that is sometimes provided, and to have a further burden of ongoing payments when a product turns out not to be best suited just adds to those issues of harm that we saw.

- - - - - we do not think consumers fully understand, when you are going into a clinic situation where you have people that you think might be trusted health professionals, that they are also being remunerated on commission, and that might influence what is being sold to you. There are those features, particularly with a potentially vulnerable subset of consumers, either because of age, the hearing issue itself or other disability. So we do think there is that quadruple whammy of impacts that apply here.

Mr Fleming: - - - one of the responses often in these scenarios is to give consumers more information. Our strong view is that that really is not going to help. Given the nature of the consumers involved and the devices themselves are very complex issues. Disclosure alone is not going to remedy the issue.

Mr Gregson: From the features we have seen in their current state, the combination of those (incentives and commissions) will very often lead to bad behaviour and, yes, we think that the issue should be very clearly looked at to stop these commissions or limit them in some way.

- - - - I think it is common when we probe these types of issues in any industry for parties to say that commission-based sales are a normal part of business. They say that providing wage incentives for performance is part of a market economy. They would say that it is an industry-wide approach, and therefore they are doing what they do elsewhere. Invariably, industry tells us that they have the culture, the protocols and the systems in place to prevent bad behaviour while these commissions exist.

Our experience as a consumer regulator is that we see in industry after industry where there are commission- based sales with vulnerable consumers, that the commissions do lead to bad incentives and bad behaviour. You have to have very strong systems and counterculture to deal with that. We have seen that in energy door-to-door and in the VET FEE-HELP space, and we are seeing public reports even in the charity sector about the way in which donations are sought by third-party providers on commission.

What is clear is that the ACC did not have any clearcut solution to the problems they describe. In Consumer Directed Care case managers will have a considerable influence on the choices that elderly consumers and their families make. It is not clear how they will be shielded from these sorts of pressures when aged care becomes part of the market economy described here.

Franchising companies are at particular risk of some of these practices. Franchising itself creates strong incentives. Multinational and local franchising companies are already setting up to supply home care to the aged in Australia. I know of at least three, one of which in the USA claimed to have "client billings (that) are nearly four times higher than the industry average" and to be able to make up to $1 million from 18 residents.

- US home care provider enters Australian market Community Care Review 30 January 2015

The Government's Aged Care Roadmap

Claim: The roadmap indicates that this is "A single aged care and support system that is market based and consumer driven, with access based on assessed need". Services will not be regulated but left to the market. It claims that "the market determines price".

But without an effective customer, a system where the market runs the show and determines price cannot be "consumer driven. This will not contain cost blowouts for consumers who will be at risk of exploitation.

Claim: "Consumers will be viewed as active partners throughout the care journey".

But without addressing the power imbalance, this will be at the discretion of the marketplace.

Claim: The roadmap "gives providers freedom to be innovative".

But it does not give the community the same freedom. Innovation is likely to be of benefit for providers rather than consumers.

Claim: "Contestability of delivery will promote quality, productivity, efficiency, innovation and value for money services that are responsive to consumer needs and preferences," is enshrined in the Aged Care Sector Statement of Principles. That comes straight out of some free market handbook.

But contestability requires a knowledgeable and powerful customer. It requires the proposed Community Aged care Hub if it is to work.

Claim: "... a light touch approach to regulation will give providers freedom to be innovative in how they deliver services." This is also from the Aged Care Sector Statement of Principles - another bit from some free market handbook where it is called "liberalisation".

But this requires an effective customer and an active and involved civil society. What is needed is effective low impact on site regulation like that proposed for the hub. As many examples show, in an unregulated free market context corporations find innovative ways of serving themselves rather than customers, and then justifying this to themselves. I look at this and give many examples on three web pages in the section Cultural perspectives.

Claim: "Consumers will drive quality and innovation by exercising choice as to which provider/s they use" and "packages are portable."

But the elderly seek stability, known faces and a known environment. They are easily disoriented by change and rarely exercise this choice. Furthermore, their ability to port to another provider when they have been sold snake oil will be discouraged because, as is reported on Australian Ageing Agenda, "exit fees (are) charged when a consumer switched providers or left their package". That information will not be publicly available when they first choose a provider.

Claim: There will be a strong focus on positive images of aged care.

But "positive images" should be read as advertising and a continuation of the present deceptively positive advertising. This is the medium for selling snake oil. What prospective residents and family needed is the data that the system does not collect or publish and assistance from a knowlegeable and trusted personal empathic support system.

Note that: The philosophy underpinning the policies of this roadmap is the free market neoliberal Friedman/Reagan/Thatcher philosophy that saw social responsibility in the marketplace as a "fundamentally subversive doctrine". In free market thinking, the responsibility of managers is to shareholders and not primarily to customers.

But free market thinking turned established market theory on its head by shifting the focus to shareholders. It disregarded the central role that an effective customer plays in making markets work and that civil society plays in setting parameters. Under the guise of competition and efficiency it promoted a one size fits all centrally organised and structured approach to managing any system.

Impersonal process constrains our ability to express and engage our humanity. Aged care is a sector where this sort of engagement is essential. As a consequence of this sort of management, local communities (civil society) have been "hollowed out", losing involvement, knowledge, confidence and so the ability to play their important role in capitalist democracies - in this instance, in aged care.

Vulnerable customers are not protected and so are readily exploited. Information is tightly controlled with little transparency. Citizens are no longer able to fulfill their responsibilities to society so disengage from the plight of others. Market entities control politics as well as the thinking of a passive community that is not engaged with issues such as aged care.

The argument is that the lofty goals the Aged Care Roadmap claims are not attainable within the patterns of thinking on which it is based and with the structure that has been set in place. In almost every free market sector where customers are vulnerable they are at high risk of being exploited. There are no reasons to think that aged care is any different. In the section 19 years of care I give links to material describing many red flag examples that suggest this is already happening.

Comments made in rersponse to an article about the roadmap on Australian Ageing Agenda show that others are as sceptical as I am.

- Aged Care Roadmap: what will aged care look like in a decade? Australian Ageing Agenda 13 July 2016

A Different Aged Care Roadmap

Aged Care Crisis is supporting a different community based and structured model for the provision of aged care - a more sensible "roadmap" for the future. It complies with market theory and removes the perverse incentives in the market. It offers a much better way of attaining the lofty goals and dealing with problems that already exist. It seeks to change the administrative and management structure of aged care in such a way that the unequal balance of power and decision making is addressed. Control will be shifted from market to customer and community - a necessary condition for market theory to work.

By changing the context it eliminates the perverse incentives. It is not a radical reform, but a considered step like process that can be introduced and built in stages. On this website I am arguing against the LLLB and government roadmap and in support of a community based approach to aged care.

The following table summarises the essential differences between the LLLB proposals as represented in the roadmap for introducing them and the proposed community based aged care hub alternative. The marked info links in the table (below) when clicked on, display additional information which expand on the related cells content.

|

Dimension |

Government Aged Care Roadmap |

Aged Care Community Hub Roadmap |

|---|---|---|

|

Structure |

Hierarchical top/down info |

Local bottom/up info |

| Staffing of regulatory system |

Central info |

Local info |

|

Philosophical underpinning and organisation |

|

|

| Funding |

Centralised, structured, rigid, unresponsive info |

Managed locally, less structured, flexible, responsive to need info |

|

Consumer/Customer/family |

|

|

|

Community |

Absent or peripheral. Involved only by invitation. |

Central to the organisation and management of regional care. Significant power. info |

|

Regulation: |

Central, infrequent oversight and very occasional visits |

Local and at the bedside with central support and backup when needed. |

|

- Data collection |

Very little if any – 3 to 5 yearly accreditation visits |

|

|

- Accreditation |

|

|

|

- Complaints |

Distant, complex, process driven, delayed and ineffective |

|

|

Advocacy for individuals |

Commonwealth contracted to states. Conducted mostly by phone |

Local, directly available and supported by central service. |

|

Visitors system |

State run |

Integrated and coordinated locally by the hub |

|

Community aged care activities |

Fragmented |

Integrated and supported |

|

Providers |

Currently customer beware and distrusted |

|

| Advisory role |

|

Hub assumes advisory, information and support role based on local knowledge as well as national data. |

|

Consumer feedback |

Dependent on commercial market and various website systems that are easily gamed. |

Collected personally or else controlled by the hub which would select and work with a web based feedback service so ensuring adequate numbers and avoiding gaming of the system. |

|

Advocacy for aged care |

|

|

|

Policy Development and innovation |

Government, and corporate executives. Market driven. |

|

|

Introduction of changed system |

LLLB changes were not trialed and were simply imposed across the country in final format with fanfare. |

|

|

Research |

Arranged with provider |

|

|

Case management and assessment |

Providers manage cases creating conflicts of interest |

Hub controls or contracts for case management and assessments. |

|

Costs |

|

|

|

Competition |

|

Controlled and based on the service actually provided to the customer who is supported by the community. |